Coinbase Stock (NASDAQ:COIN): Bitcoin Euphoria Signals a Peak – TipRanks.com

[ad_1]

Coinbase Global (NASDAQ:COIN) is a company that makes most of its money from consumers trading crypto on its platform. However, the company is trying to expand its business into other crypto spaces, such as crypto storage. I’m bearish on Coinbase because its profits are tied to Bitcoin (BTC-USD) prices, which appear to be in a state of euphoria, signaling a trading volume peak. Also, the company’s business model has been questionable thus far and was funded by debt, share dilution, and Bitcoin appreciation.

Why Crypto Trading Volumes May be Peaking

Crypto strikes me as a speculative asset and one that could wane in popularity over time. Over the past few months, every time I’ve discussed investing with someone, I’ve been asked if I trade Bitcoin. Alternative’s crypto fear/greed index, which measures crypto sentiment based on six different factors, recorded a near-all-time high greed rating in March of this year.

Bitcoin seems to have captured people’s imaginations because people like to get rich quick. Everyone and their dog was talking about meme stocks in 2021, and looking back, this signaled a euphoric peak in these stocks. The same happened with the commodity of silver in 2011, but fads inevitably fade.

While Bitcoin has other uses, such as hedging against fiat currency devaluation and making under-the-table (sometimes illegal) transactions, I believe people primarily use it to gamble/speculate. Undermining crypto’s other uses, there wasn’t any U.S. currency devaluation over the past two years, as evidenced by the U.S. M2 money supply, and illicit activity puts crypto at risk of a ban.

Even as a currency, Bitcoin does a poor job because the items that can be bought with it are few and far between, and its value fluctuates dramatically.

Because of this euphoria and outlook, I think we may be near another peak in the demand for Bitcoin and other cryptocurrencies, which would be bad news for Coinbase. The company’s earnings are tied at the hip with Bitcoin prices, reporting record profits in 2021, huge losses in 2022, and now spiking earnings again in 2024. Rising prices draw traders in, and falling prices scare traders away. The other problem is that Coinbase has its own “crypto assets held for investment,” which can amplify losses.

The Business Model Has Some Flaws

Despite its $53 billion market cap, Coinbase has averaged just $68 million of operating income over the past three years, meaning its core operations aren’t very profitable. Because Coinbase has to safeguard all of its customers’ crypto and cash, the company has relatively little capital available to invest, resulting in a fairly unprofitable business.

To accommodate a business model that has some flaws, Coinbase has been increasing its long-term debt and diluting shareholders. This has helped Coinbase bring cash in the door over the past few years.

The company is now hoping to make a profit from other crypto-related services, including bitcoin storage for ETF providers like BlackRock (NYSE:BLK). However, with very small fees of 0.1% to 0.2%, I expect the revenue opportunity here to be in the millions rather than the billions. Additionally, because consumers now have the option to invest in Bitcoin ETFs with minimal fees, I expect this new revenue will only replace lost trading revenue, resulting in little growth. We could also see downward pressure on Coinbase’s trading fees.

The Valuation Is Reason Enough to be Bearish

Despite the issues I outlined above, and I didn’t even discuss the ongoing SEC lawsuit, among other risks, Coinbase trades at 13.5x sales and 6.4x book value. If we compare this to its growth, the company’s book value per share has grown at a compound annual rate of just 3.5% since 2021, and its sales have been cut in half since then.

I like to look for companies that are obviously undervalued and, as Peter Lynch once said, “avoid long shots.” Coinbase looks like a long shot to me. That doesn’t mean it can’t grow into its valuation, but looking at all the available information, I’m skeptical.

Is COIN Stock a Buy, According to Analysts?

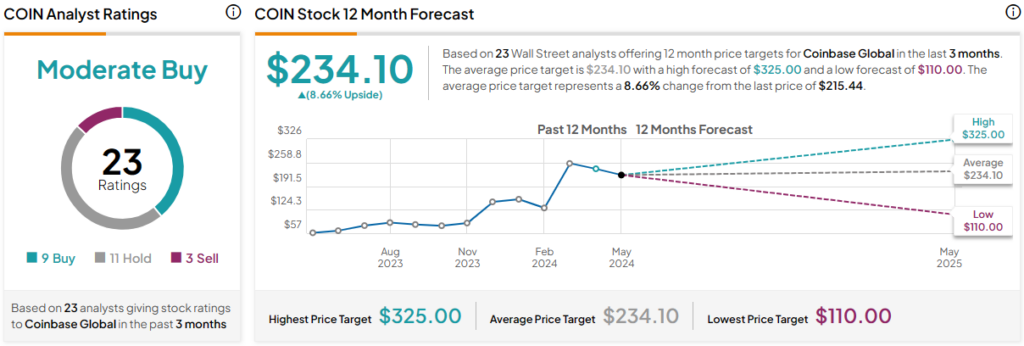

Currently, nine out of 23 analysts covering COIN give it a Buy rating, resulting in a Moderate Buy consensus rating. The average Coinbase Global stock price target is $234.10, implying upside potential of 8.7%. Analyst price targets range from a low of $110.00 per share to a high of $325.00 per share.

The Bottom Line on COIN Stock

Coinbase stock looks like what Peter Lynch would describe as a “long shot.” The valuation, at $53 billion, is quite high for a business that has only produced $68 million of average operating income over the past few years. I’m also bearish on Bitcoin, which I believe is nearing a euphoric peak and could become a fad of the past or face more government bans. With an ongoing SEC lawsuit and increasing competition from Bitcoin ETFs, I think there could be more downside ahead for COIN shares.

[ad_2]

Read More:Coinbase Stock (NASDAQ:COIN): Bitcoin Euphoria Signals a Peak – TipRanks.com

Comments are closed.