Weakening yen affects Japanese economy | NHK WORLD-JAPAN News

[ad_1]

The yen continues to weaken against the dollar, falling to the 156-yen level on Friday, the lowest in nearly 34 years. The Japanese economy is enjoying rising demand from a record number of inbound tourists. But the weakening yen is also raising concerns that higher prices will impact domestic consumption.

Record number of inbound tourists in Japan

The Japanese currency is continuing to plummet on the foreign exchange market. But this is drawing a record number of tourists to the country. The Japan National Tourism Organization says the figure topped three million in March. That’s the highest ever for a month, surpassing the record set in July 2019.

Overseas visitors spent 1.75 trillion yen, or 11.3 billion dollars, from January to March in the country.

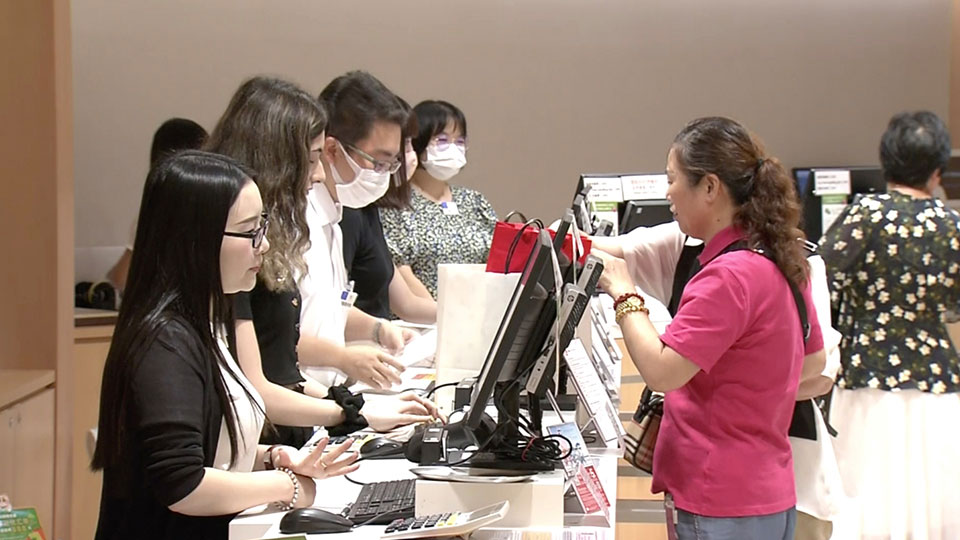

The Japan Department Stores Association announced on Thursday that sales at department stores nationwide last month were up 9.9 percent from the same month last year, marking the 25th straight month of increase.

The sales of tax-free goods were nearly 50 billion yen, a 2.4-fold increase over the same month in the previous year, marking the highest monthly sales since the survey began in 2014.

Japan Department Stores Association official Yasuda Yoko said, “The weaker yen has been a great advantage for overseas customers.” But she added: “The yen’s decline has reached the limit that can be tolerated. The situation may make it difficult for domestic customers to make purchases if the currency further depreciates.”

Business leaders voicing concerns

The weak yen is benefitting export companies. But consumers are feeling the pinch as the cost of living rises on the back of higher prices of imported goods and materials.

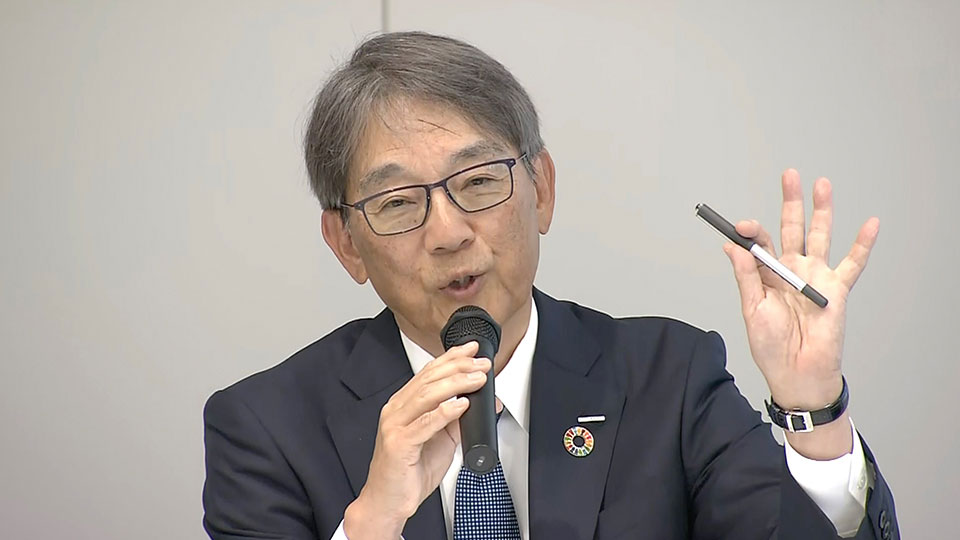

The president of chemical multinational Asahi Kasei, Kudo Koshiro, said that while his company is profiting from a weaker yen in the short term, he is worried about the consequences in the longer term. He said: “I believe the yen’s depreciation will slowly but steadily damage Japan’s economy. That includes having a negative impact on consumption.”

He added, “In a short period of time, I think the yen’s depreciation will benefit us, but in the medium term, the question is whether the value of the yen should remain as it is.”

The weak yen is also driving up stock prices in Tokyo. Investors have bought export-related shares, including automakers, on the yen’s slide against the dollar. That was a factor behind the benchmark index of the Tokyo Stock Exchange hitting an all-time high earlier this year.

The booming stock market is bringing higher profits to securities firms. But Yoshida Kotaro, the chief financial officer at one of Japan’s major brokerage firms, Daiwa Securities Group, sounded a cautious note over the yen’s excessive depreciation. He said: “There are both positive and negative aspects of the yen’s depreciation, but a sharp decline in the yen will lead to costing inflation. I expect wage hikes and robust corporate performance to continue this fiscal year, but the yen’s depreciation could push down consumption, and we need to be on the alert for excessive moves.”

He also said: “The recent depreciation of the yen is based on a view that it is difficult to narrow the difference in interest rates between Japan and the US due to geopolitical risks and an expectation that the Federal Reserve would postpone a rate cut. But we can also point out a structural factor that Japan has become difficult to earn money in trade.”

[ad_2]

Read More:Weakening yen affects Japanese economy | NHK WORLD-JAPAN News

Comments are closed.